Companies find themselves juggling more software vendors than ever

With too much to keep track of, CIOs are yielding control of some vendor management - but the transition isn’t always smooth.

Published on 20th March 2024

The amount of outside software companies are tapping has skyrocketed in the last 10 years. CIOs say they’re leaning on other areas of the business to help them manage it—but that comes with its own challenges.

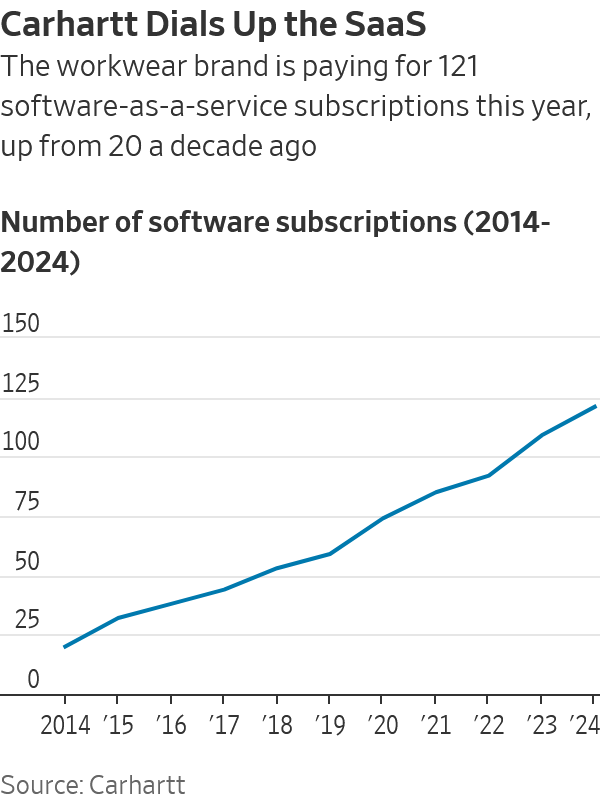

Katrina Agusti, chief information officer of workwear brand Carhartt is paying for 121 software-as-a-service subscriptions this year, up from 59 five years ago and just 20 a decade ago—an increase that’s rapidly outpacing the head count growth in the IT department itself.

“You just can’t keep pace,” she said, adding she’s letting some business teams take charge of the administrative aspect of the platforms, “just because we don’t have enough IT resources.” But with more software procurement and management happening outside IT, there are also concerns about paying for duplicate services, data integration challenges and potential loss of cost efficiencies.

The growth is fuelled in part by the greater number of tools and capabilities on the market today that organizations are looking to take advantage of, said Stephen White, vice president analyst at research and consulting firm Gartner.

Typically organizations have a handful of major key vendors, followed by a long tail that are used for smaller services. There have been cycles of trying to rationalize, consolidate and reduce the number of vendors used, but there’s also an acceptance that having more vendors makes companies less dependent on bigger ones, White said. He added that today’s AI hype is also fueling the fire as organizations look for new vendors to take advantage of cutting edge technology.

Adding to the deluge, software companies have also wised up to the idea of business counterparts’ involvement and have shifted their sales strategies to target end users, Agusti said. She said she asks existing vendors not to target business people when they have a new solution they’re trying to sell and instead go through IT.

“It’s not about control, it’s about protecting and making sure we’re being wise with our spend,” she said.

Priya Saiprasad, general partner at venture-capital firm Touring Capital, said her software portfolio companies are increasingly marketing to end users at companies, rather than CIOs. She added that when enough people at the company are using a service, that company might then approach IT for an enterprisewide license.

For some CIOs, that approach isn’t ideal.

Marc Kermisch, chief digital and information officer at agricultural machinery and construction equipment provider CNH Industrial said that software products that can easily be purchased by anyone with a credit card drive him crazy. “Next thing you know, I’ve got tens of thousands of dollars going out to a SaaS provider that I didn’t even know existed,” he said. The company has 12 key software vendors, more than double what it had five years ago, he said.

The dreaded horror of “Shadow IT,” in which employees skirt the IT department to buy their own cloud services, apps or other technologies, hasn’t returned in full force since the days when iPhones and app stores initially became ubiquitous in corporate settings. But with an increasingly digitally savvy workforce that’s increasingly involved in the software management process, CIOs say they have to put strict requirements in place to avoid it.

Moderna CIO Brad Miller said that when the company was developing and distributing a vaccine during the Covid pandemic, the number of software subscriptions it was using exploded because the company was prioritizing moving as quickly as possible.

“A lot of times my business partners were running crazy fast because they needed something. So they just went and signed licenses and there wasn’t really a tech review.” Miller said. “Everything was going so fast that it was impossible to keep track of everything.”

Since then, Miller said, he has put a stricter process in place involving more due diligence on cost and value from the IT department. Reviewing services that were unnecessary or duplicative has also allowed Moderna to reduce the number of software-as-a-service vendors it works with from 257 in 2023 to 200 this year.

To be sure, consolidation of unnecessary, expensive and duplicative vendors has been its own trend as companies have looked to get leaner in tougher economic times. Workflow automation platform company Pegasystems, for example, currently has 192 vendors, 8% to 10% less than it had five years ago thanks to reducing overlapping solutions and optimizing existing ones.

But some companies also say they need to grow the number of existing vendors they use to take advantage of cutting-edge solutions just hitting the market, especially in areas like generative AI.

“You can’t depend wholly on just your top partners to come give that kind of innovation,” said Aaron Gwinner, chief information officer of tobacco company Reynolds American Inc. “I have to look at small things that I can do that are available now.”

The company is currently using 52 software-as-a-service vendors, up from 35 in 2019 and 15 in 2014.

As far as collaborating with the business to bring in new software, Gwinner said, “It’s not always seamless, but what we’ve learned is that if we don’t do it, we’re setting ourselves up for failure.”