AWS under pressure as big three battle to dominate the cloud market

Google and Microsoft continue to close the gap, while Oracle and neoclouds are steadily growing from a small base.

Published on 25th November 2025

The big three cloud companies are all growing thanks to an expanding market, but Amazon is under increasing pressure from Microsoft and Google, while newcomers are on the rise.

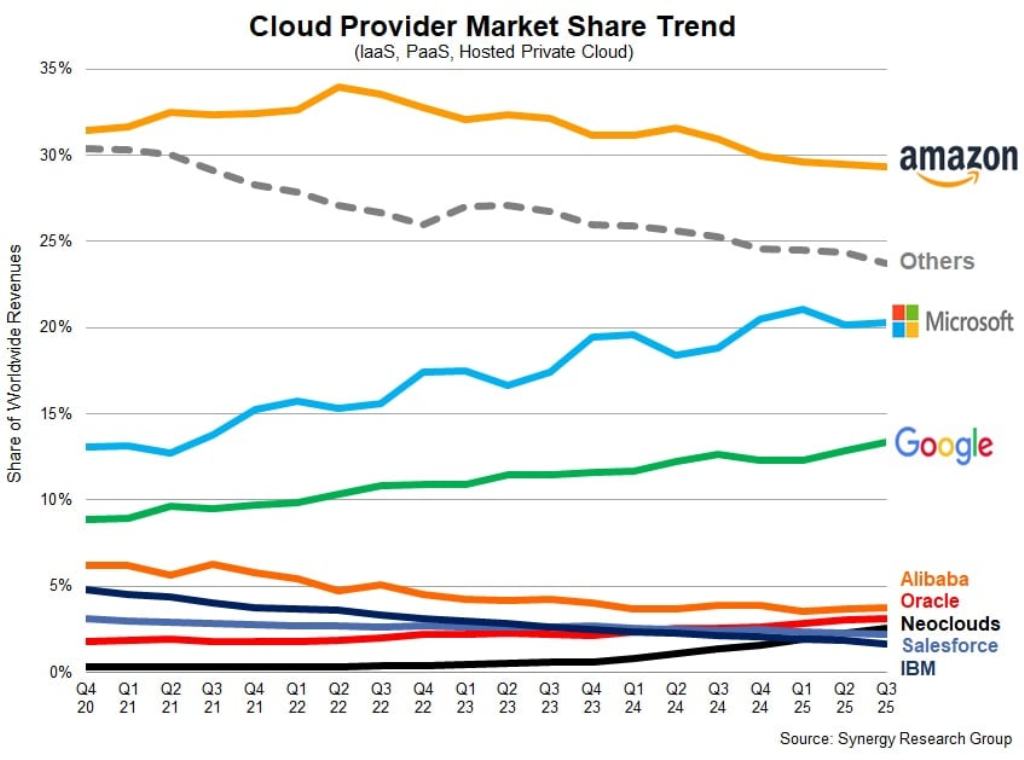

Synergy Research has published data showing market share by spend in global cloud infrastructure services over the last twenty quarters.

According to its figures, the big three operators – Amazon (AWS), Microsoft (Azure) and Google Cloud – accounted for a collective 63 percent of enterprise cloud infra spending during Q3 of 2025. In the same quarter a year ago, it was 62 percent, and a year before that, it was 61 percent, showing that the cloud triumvirate continues to gradually take market share from the other players.

That’s a larger share of a larger pie, as the market for cloud infrastructure services hit $107 billion in Q3, up from $68 billion two years ago, an increase of nearly 60 percent.

Meanwhile, Synergy’s chart seems to show that Amazon’s share of the entire market peaked in Q2 of 2022, and has been slowly declining ever since. Because the overall market is expanding, this doesn’t mean that Amazon is losing business, just that it is being outgrown by other players.

AWS still has a comfortable lead, with 29 percent of global market spend in Q3, but Microsoft and Google, the junior pair in the cloud triumvirate, are steadily increasing their market shares, accounting for 20 percent and 13 percent respectively.

Microsoft’s performance is cyclical quarter to quarter, but with an underlying upward trend.

Other cloud players have a much smaller piece of the market action, but Synergy highlights Oracle and the so-called neoclouds as slowly gaining share. The neoclouds are relative newcomers focused on providing access to GPU clusters and AI development environments rather than standard cloud services. CoreWeave is by far the largest player here, but others growing rapidly include Crusoe, Nebius and Lambda. The only clear loser among the small players is IBM, which has steadily declined from five percent of market spend in Q4 2020 to about half that amount now.

In a statement, Synergy Chief Analyst John Dinsdale noted it was “striking” how effectively AWS has maintained its lead, while noting that the big three are still dominant, with Google having nearly 4x the revenue share of the global number-four player, Alibaba.

Overall, the cloud market continues to grow strongly in all regions of the world. Those countries with the strongest growth in Q3 2025 included India, Australia, Indonesia, Ireland, Mexico, and South Africa, all growing at rates above the global average.

But the US remains by far the largest cloud market, bigger than the whole APAC region combined, and grew by 28 percent during the quarter. In Europe, the largest cloud markets remain the UK and Germany, but those with the highest growth rates were Ireland, Spain, and Italy.